Community Reinvestment Act Public File

Crossroads Bank is dedicated to meeting the needs of the communities it serves. The Community Reinvestment Act (CRA) is a federal law that aims to ensure financial institutions meet the credit needs of their local communities, particularly in low- and moderate-income neighborhoods, and to small businesses and small farms. Certain information specified in the regulation to be made publicly available is outlined below.

Banking Branches Hours of Operation

Lobby: Monday-Friday 8:30am to 5:00pm

Lobby: Saturday by appointment 8:30am to 12:00pm

Drive Up: Monday-Thursday 8:00am to 5:00pm

Drive Up: Friday 8:00am to 5:00pm, Wabash/Main Banking Branch 8:00am to 6:00pm

Drive Up: Saturday 8:00am to 12:00pm

Banking Branches

Wabash/Main Banking Branch

1205 N Cass St, PO Box 259

Wabash, IN 46992

(260) 563-3185

(260) 563-4841 fax

State-County-Census Tract: 18-169-1027.00

North Manchester Banking Branch

1404 State Road 114 West, PO Box 328

North Manchester, IN 46962

(260) 982-2188

(260) 982-2180 fax

State-County-Census Tract: 18-169-1022.00

Syracuse Banking Branch

500 S Huntington St, PO Box 188

Syracuse, IN 46567

(574) 457-4411

(574) 457-4412 fax

State-County-Census Tract: 18-085-9610.02

Warsaw Banking Branch

895 N Parker St

Warsaw, IN 46582

(574) 306-4497

(574) 267-4426 fax

State-County-Census Tract: 18-085-9620.00

South Whitley Banking Branch

207 S State St, PO Box 515

South Whitley, IN 46787

(260) 723-5127

(260) 723-6851 fax

State-County-Census Tract: 18-183-0503.00

Columbia City Banking Branch

526 W Connexion Way, PO Box 289

Columbia City, IN 46725

(260) 248-2265

(260) 248-8012 fax

State-County-Census Tract: 18-183-0504.02

Peru Banking Branch

855 N Broadway

Peru, IN 46970

(765) 327-4064

(765) 327-4493 fax

State-County-Census Tract: 18-103-9521.00

No new branches have been opened in the current year or prior two calendar years.

No branches have been closed in the current year or prior two calendar years.

Products, Services, Delivery Systems

Products & Services

- Savings Accounts: Certificates of Deposit, Statement Savings, Looney Tunes Savings Club, Christmas Club, Money Market Account, CDAR Program (FDIC insured deposits over $250,000), Health Savings Accounts

- Consumer Checking Accounts: Easy Checking, Easy Interest Checking, Preferred Rate Checking, 50 Advantage Checking, Consumer Fiduciary Checking

- Business Checking Accounts: Community Checking-free for non-profits & sole proprietors, Easy Business Checking, Business Interest Checking, Commercial Checking, Business Fiduciary Checking

- Loans: Conventional Mortgages, Adjustable Rate Mortgages, Construction Loans, Investment Property Loans, Home Equity Loans, Home Improvement Loans, Personal & Auto Loans

- Commercial Lending: Commercial Loans, Agricultural Loans, Tax Leases, Fixed-purchase Leases, FASB 13-Operating Leases, TRAC Leases for Commercial Motor Vehicles, Master Lease Lines of Credit, Equipment Loans, Tax-exempt Municipal Leases for State & Local Governments

Alternative Delivery Systems

- Toll-Free Live Receptionist: calling customers always receive a live employee during business hours, not an automated service, ensuring needs are addressed promptly and accurately

- Toll-Free Automated Telephone Banking: account balances, transfers, and loan payments can be accessed 24 hours a day

- Extended Drive-Through Hours: early hours daily at each branch, extended afternoon hours Fridays at Wabash/Main Banking Branch

- 24-Hour Night Drop Service: at each branch

- Free Internet Banking and Bill Pay: account balances, transfers, loan payments, account balancing tools, E-statements, mobile deposit capture and bill pay are available for free 24 hours a day

- Commercial Online Banking with Bill Pay, ACH and Positive Pay Features

- Personal or Business Debit or Credit Card Services

- Merchant Services

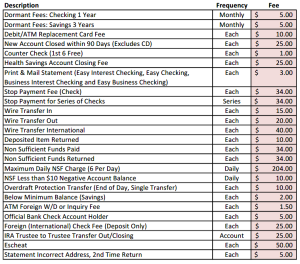

Miscellaneous Deposit Service Fees

Deposit Account Fees:

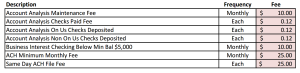

Commercial Checking Fees:

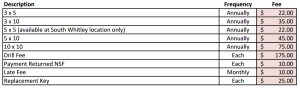

Safe Deposit Box Fees:

Assessment Area

Home Mortgage Disclosure Act Notice

The HMDA data about our residential mortgage lending are available online for review. The data show geographic distribution of loans and applications; ethnicity, race, sex, age, and income of applicants and borrowers; and information about loan approvals and denials. These data are available online at the Consumer Financial Protection Bureau’s Web site (www.consumerfinance.gov/hmda). HMDA data for many other financial institutions are also available at this Web site.

Loan to Deposit Ratios

PUBLIC DISCLOSURE

October 24, 2023

COMMUNITY REINVESTMENT ACT

PERFORMANCE EVALUATION

Crossroads Bank

Certificate Number: 29839

1205 N Cass St

Wabash, Indiana 46992

Federal Deposit Insurance Corporation

Division of Depositor and Consumer Protection

Chicago Regional Office

300 South Riverside Plaza, Suite 1700

Chicago, Illinois 60606

This document is an evaluation of this institution’s record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, nor should it be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution.

TABLE OF CONTENTS

- INSTITUTION RATING

- DESCRIPTION OF INSTITUTION

- DESCRIPTION OF ASSESSMENT AREAS

- SCOPE OF EVALUATION

- CONCLUSIONS ON PERFORMANCE CRITERIA

- DISCRIMINATORY OR OTHER ILLEGAL CREDIT PRACTICES REVIEW

- INDIANA NON-MSA ASSESSMENT AREA – Full-Scope Review

- FORT WAYNE, IN MSA ASSESSMENT AREA– Full-Scope Review

- APPENDICES

- INTERMEDIATE SMALL BANK PERFORMANCE CRITERIA

- GLOSSARY

INSTITUTION RATING

INSTITUTION’S CRA RATING: This institution is rated Satisfactory.

An institution in this group has a satisfactory record of helping to meet the credit needs of its assessment area, including low- and moderate-income neighborhoods, in a manner consistent with its resources and capabilities.

The Lending Test is rated Satisfactory.

- The loan-to-deposit (LTD) ratio is reasonable given the institution’s size, financial condition, and assessment area credit needs.

- A majority of the bank’s home mortgage and small business loans are within the assessment areas.

- The geographic distribution of loans reflects reasonable dispersion throughout the assessment areas.

- The distribution of borrowers reflects, given the demographics of the assessment areas, reasonable penetration of loans among individuals of different income levels and businesses of different sizes.

- The institution did not receive any CRA-related complaints since the previous evaluation; therefore, this factor did not affect the Lending Test rating.

The Community Development Test is rated Satisfactory.

The institution demonstrates adequate responsiveness to the community development needs of its assessment areas through community development loans, qualified investments, and community development services, as appropriate. Examiners considered the institution’s capacity and the need and availability of such opportunities for community development in the assessment areas.

DESCRIPTION OF INSTITUTION

Crossroads Bank is a full-service community bank headquartered in Wabash, Indiana. The bank is a wholly-owned subsidiary of FFW Corporation, a single-bank holding company also headquartered in Wabash, Indiana. The bank received a “Satisfactory” rating at its previous FDIC CRA Performance Evaluation dated September 28, 2020, based on Interagency Intermediate Small Institution Examination Procedures.

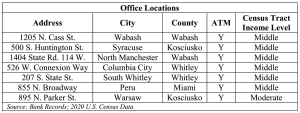

In addition to the main office, Crossroads Bank operates six full-service branches within its assessment areas. The following table provides additional information on the branch locations using 2020 U.S. Census Data.

Crossroads Bank offers a variety of loan and deposit products for both retail and commercial customers. Deposit products include checking, savings, money market, health savings, individual retirement accounts, and certificates of deposit. Other services include online, mobile, and telephone banking, electronic bill payment, remote deposit capture, person-to-person payments, online loan applications, and insurance and investment sales.

Retail lending products include fixed- and adjustable-rate home mortgages, home equity loans/lines, personal, automobile, recreational vehicle/boat, and credit cards. Commercial products include real estate and equipment loans, credit cards, business lines of credit, and Small Business Administration Loans.

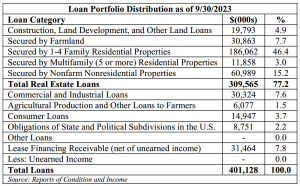

According to the Consolidated Report of Condition (Call Report) dated September 30, 2023, the bank had total assets of $541.9 million; total loans of $401.1 million; total deposits of $493.8 million; and total equity capital of $38.6 million. As of the same date, the net LTD ratio was 80.2 percent, and the net loans-to-total assets ratio was 73.0 percent. The following table illustrates the loan portfolio as of September 30, 2023. The major categories of loans by dollar volume are home mortgages (including multi-family) and commercial (including real estate), at 49.4 percent and 22.8 percent, respectively.

Examiners did not identify any financial constraints or legal impediments that would preclude Crossroads Bank from reasonably meeting the credit and community development needs of the assessment areas.

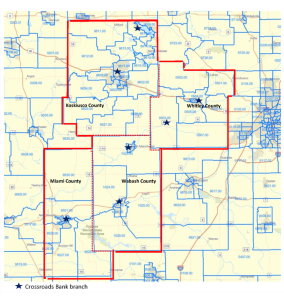

DESCRIPTION OF ASSESSMENT AREAS

The CRA requires each financial institution to define one or more assessment areas within which to evaluate its CRA performance. Crossroads Bank designated two assessment areas, briefly described below. Both assessment areas remain unchanged from the prior evaluation. This evaluation contains separate sections for each assessment area that include additional, detailed information.

The first assessment area is the Indiana Non-Metropolitan Statistical Area (Indiana Non-MSA). It consists of counties within Indiana as follows: Wabash, Kosciusko, and Miami Counties in their entirety. The second assessment area is part of the Fort Wayne, Indiana Metropolitan Statistical Area (Fort Wayne, IN MSA) and consists of Whitley County in its entirety.

The assessment areas consist of contiguous, whole geographies where the bank operates its deposit-taking offices and ATMs. The assessment areas do not reflect illegal discrimination or arbitrarily exclude low- and moderate-income geographies.

SCOPE OF EVALUATION

General Information

This evaluation covers the period from the prior evaluation dated September 28, 2020, to the current evaluation dated October 24, 2023. Examiners used the Interagency Intermediate Small Institution Examination Procedures to evaluate Crossroads Bank’s performance, which includes two tests: The Small Bank Lending Test (Lending Test) and the Community Development Test. The first Appendix contains information about the performance criteria for each test. Institutions must achieve a rating of at least “Satisfactory” under each test to obtain an overall “Satisfactory” rating.

Examiners used information provided by the bank, Home Mortgage Disclosure Act (HMDA) data, 2020 U.S. Census data, D&B business demographic data, and information from community contacts. Examiners used American Community Survey estimates that refresh every five years when considering census demographics throughout this evaluation. For 2022 data presented in the evaluation, examiners assessed the bank’s performance using 2020 U.S. Census data.

As noted in the previous section, Crossroads Bank designated two separate assessment areas, both of which are located entirely within the State of Indiana. Examiners conducted full-scope reviews on each area. When determining overall performance, examiners placed more weight on the bank’s performance in the Indiana Non-MSA assessment area, because it contains the majority of the reviewed lending activity and a significant majority of the institution’s deposit and branch locations.

Activities Reviewed

Examiners determined that the bank’s major product lines are home mortgage and small business loans. This conclusion considered the bank’s business focus, loan portfolio composition, and the number and dollar volume of loans originated during the evaluation period. No other loan types, such as small farm or consumer loans represent major product lines. Other loan types, therefore, provided no material support for conclusions or ratings and are not presented.

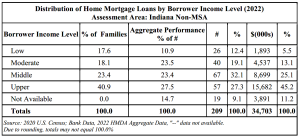

Bank records indicate that the lending focus and product mix remained relatively consistent throughout the evaluation period. While home purchase and refinance activity decreased due to rate increases in 2022, small business and open-end line of credit originations remained consistent. This evaluation considers all residential real estate loans reported on Crossroads Bank’s 2020, 2021, and 2022 HMDA Loan Application Registers. The bank originated 895 home mortgage loans totaling $141.6 million in 2020, 620 loans totaling $95.7 million in 2021, and 560 loans totaling $77.3 million in 2022. Aggregate HMDA data for each year provided a standard of comparison for home mortgage loans. While the volume of loans varied between years, overall lending performance was generally consistent throughout the evaluation period. Therefore, only 2022 data is presented in Geographic Distribution and Borrower Profile analyses in this evaluation.

Additionally, this evaluation considers all 2022 small business loans for the Assessment Area Concentration and Geographic Distribution performance criteria. The bank originated 141 small business loans totaling $18.5 million in 2022. The bank is not required to collect or report borrower revenue data for small business loans; therefore, examiners reviewed a sample of the 2022 small business lending for the Borrower Profile criterion. D&B data for 2022 provided a standard of comparison for small business loans.

Crossroads Bank’s primary focus is home mortgage lending. Examiners reviewed open-end home mortgage loans separately from closed-end home mortgage loans because the bank originated a substantial amount of both products, and borrower profile performance varied between the products in 2022. Examiners placed a greater emphasis on closed-end home mortgage lending in the overall rating, followed by small business lending and open-end home equity lending.

For the Lending Test, examiners reviewed the number and dollar volume of home mortgage and small business loans. While this evaluation presents the number and dollar volume of loans, examiners emphasized performance by number because it is a better indicator of the number of individuals and businesses served.

For the Community Development Test, bank management provided data on community development loans, qualified investments, and community development services since the prior CRA evaluation.

CONCLUSIONS ON PERFORMANCE CRITERIA

LENDING TEST

Crossroads Bank demonstrated reasonable performance under the Lending Test. The LTD ratio, geographic distribution, and borrower profile performance primarily supports this conclusion.

Loan-to-Deposit Ratio

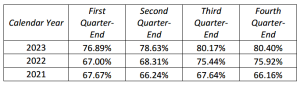

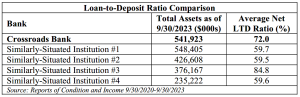

The LTD ratio is reasonable considering seasonal variation and taking into account lending-related activities, given the institution’s size, financial condition, and assessment area credit needs. The bank’s LTD ratio, calculated from Call Report data, averaged 72.0 percent over the past 13 calendar quarters from September 30, 2020 to September 30, 2023. The bank’s ratio fluctuated slightly during the evaluation period overall. It ranged from a high of 80.2 percent as of September 30, 2023, to a low of 66.2 percent as of December 31, 2021. As shown in the following table, the bank’s average LTD ratio is within the range of four similarly-situated institutions (SSIs), which examiners selected based on asset size, geographic location, and lending focus.

Assessment Area Concentration

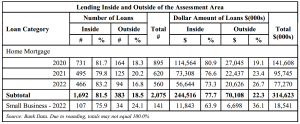

By number and dollar volume, Crossroads Bank originated a majority of its home mortgage and small business loans within the assessment areas during the review period, as reflected in the following table.

Geographic Distribution

The geographic distribution of loans reflects reasonable dispersion throughout the assessment areas. A complete discussion of the performance for this criterion is in the separate assessment area sections of this evaluation.

Borrower Profile

The distribution of borrowers reflects reasonable penetration overall among retail customers of different income levels and businesses of different sizes. A complete discussion of the performance for this criterion is in the separate assessment area sections of this evaluation.

Response to Complaints

The bank did not receive any CRA-related complaints since the previous evaluation; therefore, this criterion did not affect the Lending Test rating.

COMMUNITY DEVELOPMENT TEST

Overall, Crossroads Bank’s community development performance demonstrates adequate responsiveness to the needs of the assessment areas through a blend of community development loans, qualified investments, and community development services, considering the institution’s capacity and the availability of such opportunities within the assessment areas. The following sections present overall conclusions, and the separate assessment area discussions later in this evaluation contain additional details.

Community Development Loans

Crossroads Bank originated 19 community development loans within the assessment areas totaling $2.4 million during the evaluation period. This level of activity represents 0.5 percent of the average total assets and 0.7 percent of average net loans since the prior CRA evaluation. Crossroads Bank has been responsive to the needs of its assessment areas; therefore, examiners also considered 14 community development loans totaling $16.1 million, which benefitted a broader regional area that includes the bank’s assessment area. Most of these loans supported multifamily affordable housing rehabilitation projects approved by the United States Department of Agriculture.

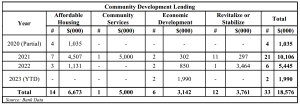

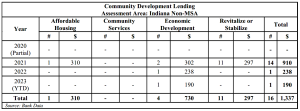

The CARES Act created the Paycheck Protection Program (PPP) in 2020. PPP loans were SBA- backed loans that helped businesses keep their workforce employed during the COVID-19 pandemic. This program ended on May 31, 2021. PPP loans that promoted job retention for low- and moderate-income persons and/or in low-and moderate-income census tracts may be considered community development loans. The following table depicts the bank’s total community development lending activities during the evaluation period, including 11 applicable PPP loans.

Excluding PPP loans, the bank originated eight non-PPP loans at this evaluation within the assessment area totaling $2.2 million, representing 0.4 percent of the average total assets and 0.6 percent of the average net loans. This performance trails the bank’s performance at the previous evaluation when the bank originated 50 non-PPP community development loans totaling $8.1 million. Examiners compared Crossroads Bank’s performance to three SSIs, whose community development lending ranged from 0.7 to 4.6 percent of average total assets, and 0.5 to 6.8 percent of average net loans. The following table illustrates the bank’s community development lending activity by year and purpose.

Qualified Investments

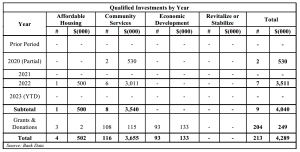

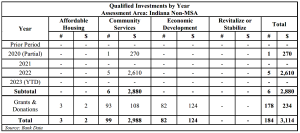

During the evaluation period, Crossroads Bank originated six new investments within its assessment areas totaling $2.9 million. Additionally, the bank made 204 donations totaling approximately $249,000. Crossroads Bank has been responsive to the needs of its assessment areas; therefore, examiners also considered three qualified investments totaling $1.2 million, which benefitted a broader regional area that includes the bank’s assessment area. The dollar amount of investments during the evaluation period represents 0.8 percent of average total assets and 3.8 percent of average total securities. This level of activity represents an increase since the prior evaluation, where the bank had 206 qualified investments and donations totaling $1.7 million.

Examiners also compared Crossroads Bank’s performance to three SSIs, whose qualified investments ranged from 0.9 to 1.6 percent of average total assets, and 2.2 to 17.2 percent of average total securities. The bank’s activity levels are generally within the range of the SSIs’ performance. The separate assessment area sections later in this evaluation contain additional details.

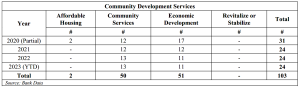

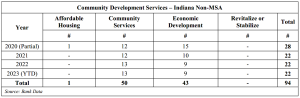

Community Development Services

Crossroads Bank provided 103 instances of community development services throughout the assessment areas during the review period, as shown in the following table. This level of activity represents similar performance to the prior evaluation, where 102 services were provided. Crossroads Bank’s performance significantly exceeded the three SSIs, whose qualified services ranged from 24 to 58 instances. The separate assessment area sections later in this evaluation contain additional details.

DISCRIMINATORY OR OTHER ILLEGAL CREDIT PRACTICES REVIEW

The bank’s compliance with laws relating to discrimination and other illegal credit practices was reviewed, including the Fair Housing Act and the Equal Credit Opportunity Act. Examiners did not identify any discriminatory or other illegal credit practices.

INDIANA NON-MSA ASSESSMENTAREA – Full-Scope Review

DESCRIPTION OF INSTITUTION’S OPERATIONS IN INDIANA NON-MSA ASSESSMENT AREA

The assessment area consists of the entirety of Kosciusko, Miami, and Wabash Counties. Crossroads Bank operates five full-service branches within this assessment area. As of June 30, 2023, 80.5 percent of the bank’s total deposits are from this area. In 2022, the bank originated 68.4 percent of its home mortgage loans and 62.4 percent of small business loans, by number, in this assessment area.

Economic and Demographic Data

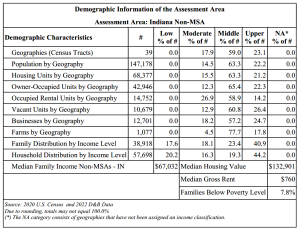

The assessment area consists of 39 census tracts with the following income designations according to the 2020 U.S. Census data: 0 low-, 7 moderate-, 23 middle-, and 9 upper-income. The following table illustrates select demographic characteristics of the assessment area.

According to 2020 U.S. Census data, the assessment area contains 68,377 housing units. Of those, 62.8 percent are owner-occupied, 21.6 percent are rentals, and 15.6 percent are vacant.

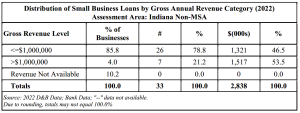

According to D&B Data, there were 12,701 non-farm businesses with the following gross annual revenue (GAR) levels:

- 85.8 percent have $1.0 million or less

- 4.0 percent have more than $1.0 million

- 10.2 percent have unknown revenues

The largest industries in the Indiana Non-MSA assessment area include services (31.5 percent), retail trade (11.1 percent), finance, insurance, and real estate (9.8 percent), agriculture, forestry, and fishing (7.8 percent), and construction (6.6 percent). In addition, 90.7 percent of businesses operate from a single location, and 63.1 percent have four or fewer employees. The largest employers in the assessment area include Zimmer Biomet Holdings, LSC Communications, and Ford Meter Box Company.

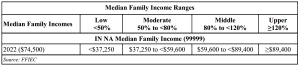

The analysis of residential mortgages under the Borrower Profile criterion compares the distribution of loans by borrower income level. Income levels are based on the FFIEC-adjusted Median Family Income (MFI). The following table shows the income categories for the assessment area.

Unemployment data obtained from the U.S. Bureau of Labor and Statistics shows that the unemployment levels in the assessment area varied by county. Data was fairly consistent for Kosciusko County and Wabash County compared to state and national data. However, the unemployment rates in Miami County generally fared worse than the state and national averages throughout the review period. Overall, unemployment rates declined since 2020, as illustrated in the following table.

Competition

There is a moderate level of competition for deposits within the assessment area. As of June 30, 2023, 16 FDIC-insured institutions operated 47 offices with deposits of $3.3 billion. Crossroads Bank ranked third with 12.0 percent of the market share. The top two banks hold 53.7 percent of the deposit market share.

There is high competition for home mortgage loans among several banks, credit unions, and non- depository mortgage lenders in the assessment area. In 2022, 239 lenders reported 4,684 originated or purchased residential mortgage loans, indicating high demand and competition for this product. Of these institutions, Crossroads Bank ranked third with 8.2 percent of the market share. The two most prominent lenders account for 18.8 percent of the total market share.

The bank is not required to collect or report its small business lending data; therefore, analysis of small business loans does not include comparisons to aggregate data. However, aggregate data is useful in identifying the level of demand for such loans. In 2021, the most recent year in which data is available, 57 lenders reported 2,987 small business loan origination in the assessment area, indicating moderate demand and competition for this product. The five most prominent small business lenders account for 59.6 percent of total market share.

Community Contacts

As part of the evaluation process, examiners contact third parties active in the assessment area to assist in identifying credit and community development needs. This information helps determine whether local financial institutions are responsive to these needs, and what credit and community development opportunities are available.

For this evaluation, examiners reviewed a contact with a representative of a community development organization that operates in the assessment area. The contact cited affordable housing as a significant need in the assessment area. The contact stated that in many cases, while local financial institutions offer home mortgage products that meet the needs of low- and moderate-income families, potential borrowers are often unaware of these products. As such, opportunities exist for more extensive outreach in low- and moderate-income communities. Additionally, the contact identified small business lending as an opportunity for increased bank involvement.

Credit and Community Development Needs and Opportunities

Considering information from the community contact, bank management, and demographic and economic data, examiners determined home mortgage and small business lending represent the primary credit needs in the assessment area. Additionally, opportunities exist for affordable housing and financial education and community services targeted to low- and moderate-income individuals.

CONCLUSIONS ON PERFORMANCE CRITERIA IN INDIANA NON-MSA ASSESSMENT AREA

LENDING TEST

Crossroads Bank demonstrated reasonable performance in this assessment area under the Lending Test. Geographic Distribution and Borrower Profile performance support this conclusion.

Geographic Distribution

The geographic distribution of loans reflects reasonable dispersion throughout the assessment area overall, based on the combined performance for the three loan products. As noted previously, the assessment area does not contain any low-income census tracts.

Closed-End Home Mortgage Loans

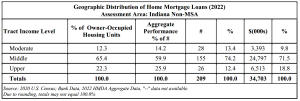

The geographic distribution of closed-end home mortgage loans reflects reasonable dispersion throughout this assessment area. As shown in the following table, Crossroads Bank’s lending in the moderate-income tracts is slightly less than, but comparable to aggregate performance.

Open-End Home Mortgage Loans

The geographic distribution of open-end home mortgage loans reflects reasonable dispersion throughout this assessment area. As shown in the following table, Crossroads Bank’s lending in the moderate-income tracts is slightly less than, but comparable to aggregate performance.

Small Business Loans

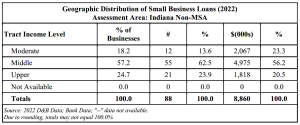

The geographic distribution of small business loans reflects reasonable dispersion throughout the assessment area. While the percentage of small business loans originated in moderate-income census tracts trails the percentage of businesses, performance improved significantly from the prior evaluation when the bank originated zero loans in moderate-income census tracts. The following table shows the distribution of small business loans within the assessment area, and includes comparative data for the distribution of businesses by tract income level.

Borrower Profile

The distribution of borrowers reflects reasonable penetration among borrowers of different income levels and businesses of different sizes.

Closed-End Home Mortgage Loans

The distribution of borrowers reflects reasonable penetration among borrowers of different income levels. While the bank’s lending to low-income borrowers was below the percentage of families, it is above the aggregate performance of all HMDA-reporting lenders in 2022. U.S. Census data shows that 7.8 percent of families in the assessment area had incomes below the poverty level. Those families would be unlikely to qualify for loans in amounts sufficient to purchase a home in the assessment area. The bank’s lending to moderate-income borrowers exceeds the percentage of families while trailing the aggregate data, supporting reasonable performance.

Open-End Home Mortgage Loans

The distribution of borrowers reflects excellent penetration among borrowers of different income levels. While the bank’s lending to low-income borrowers was below the percentage of families, it significantly exceeds aggregate performance of all HMDA-reporting lenders in 2022. The bank’s lending to moderate-income borrowers significantly exceeds both the percentage of families and the aggregate data.

Small Business Loans

The distribution of borrowers reflects, given the demographics of this assessment area, reasonable penetration among businesses of different sizes. The bank’s lending to businesses with GARs of $1 million or less trails the percentage of businesses. The percentage of businesses, however, is not necessarily indicative of small business loan demand. Smaller businesses may seek alternative forms of financing, such as credit cards or home equity lines of credit; therefore, the bank’s performance is reasonable.

COMMUNITY DEVELOPMENT TEST

The bank’s community development performance demonstrates adequate responsiveness to the community development needs in the assessment area, primarily through qualified investments, community development services, and community development loans. Examiners considered the institution’s capacity and the need and availability of such opportunities.

Community Development Loans

The bank originated 16 community development loans totaling $1.3 million during the evaluation period within this assessment area. Excluding PPP loans, the bank extended five loans totaling $1.0 million. This slightly trails the performance at the previous evaluation, which included nine community development loans totaling $1.2 million. The following table illustrates the bank’s community development lending by year and purpose.

Notable examples of the bank’s community development loans includes three loans originated in 2021 and 2022 totaling $540,000 to support small farms through the Farm Service Agency.

Qualified Investments

During the evaluation period, Crossroads Bank made 184 qualified investments and donations in this assessment area totaling approximately $3.1 million. This performance is an increase from the prior evaluation when the bank made 171 qualified investments and donations totaling $1.2 million. The following table illustrates the bank’s community development lending activity by year and purpose.

Notable examples of qualified investments and donations include:

- Four investments totaling $2.1 million to build a school serving low- and moderate-income students.

- One investment totaling $238,000 to build a public library in a moderate-income census tract.

- 24 donations totaling approximately $80,000 to an organization supporting small business retention and development in the assessment area.

Community Development Services

During the evaluation period, bank employees provided 94 instances of community development services, which is an increase from the 77 instances provided at the last evaluation. The following table illustrates community development services by year and purpose.

Notable examples of community development services include:

- Serving on the Board of Directors for an organization focused on small business development and redevelopment of buildings into low- and moderate-income housing.

- Serving as a committee member of an organization that provides grants to non-profit organizations serving low- and moderate-income individuals and families.

- Serving on the Board of Directors for an organization supporting services to low- and moderate-income individuals and elderly citizens.

- Serving on the Board of Directors and as the Treasurer for an organization that builds and funds homes for low-income families.

FORT WAYNE, IN MSA ASSESSMENT AREA– Full-Scope Review

DESCRIPTION OF INSTITUTION’S OPERATIONS IN FORT WAYNE, INDIANA MSA ASSESSMENT AREA

The assessment area consists of the entirety of Whitley County. Crossroads Bank operates two full-service branches within Whitley County. As of June 30, 2023, 19.5 percent of the bank’s total deposits are from this area. In 2022, the bank originated 14.8 percent of home mortgage loans and 13.5 percent of small business loans, by number, in this assessment area.

Economic and Demographic Data

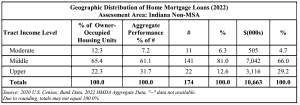

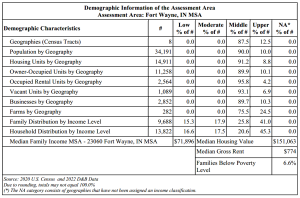

The assessment area consists of eight census tracts with the following income designations according to the 2020 U.S. Census data: no low- or moderate-, seven middle-, and one upper- income. The following table illustrates select demographic characteristics of the assessment area.

According to 2020 U.S. Census data, the assessment area contains 14,911 housing units. Of those, 75.5 percent are owner-occupied, 17.2 percent are rentals, and 7.3 percent are vacant.

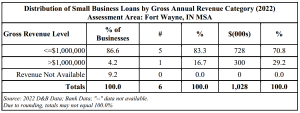

According to D&B Data, there were 2,852 non-farm businesses with the following GAR levels:

- 86.6 percent have $1.0 million or less

- 4.2 percent have more than $1.0 million

- 9.2 percent have unknown revenues

The largest industries in the assessment area include services (31.7 percent), finance, insurance, and real estate (11.4 percent), retail trade (10.3 percent), agriculture, forestry, and fishing (8.7 percent), and construction (6.3 percent). In addition, 92.2 percent of businesses operate from a single location, and 65.3 percent have four or fewer employees. The largest employers in the assessment area include Steel Dynamics Inc., Undersea Sensor Systems Inc., and C&A Tool Engineering Inc.

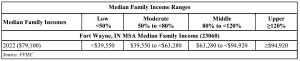

As noted earlier, the analysis of residential mortgages under the Borrower Profile criterion compares the distribution of loans by borrower income level. Income levels are based on the FFIEC-adjusted MFI. The following table shows the income categories for the assessment area.

Unemployment data obtained from the U.S. Bureau of Labor and Statistics shows that the unemployment levels in the assessment area fared better than the state and national averages throughout the review period. Unemployment rates declined since 2020, as illustrated in the following table.

Competition

There is a moderate level of competition for deposits within the assessment area. As of June 30, 2023, 7 FDIC-insured institutions operate 10 offices with deposits of $651.9 million. Crossroads Bank ranked third with 14.9 percent of the market share. The top two banks hold 53.2 percent of the deposit market share.

There is moderate competition for home mortgage loans among several banks, credit unions, and non-depository mortgage lenders in the assessment area. In 2022, 130 lenders reported 1,361 originated or purchased residential mortgage loans, indicating moderate demand and competition for this product. Of these institutions, Crossroads Bank ranked third with 6.1 percent of the market share. The two most prominent lenders account for 21.2 percent of the total market share.

As noted earlier, the bank is not required to collect or report its small business lending data; therefore, analysis of small business loans does not include comparisons to aggregate data. However, aggregate data is useful in identifying the level of demand for such loans. In 2021, the most recent year in which data is available, 38 lenders reported 708 small business loan originations in the assessment area, indicating moderate demand and competition for this product. The five most prominent small business lenders account for 67.2 percent of total market share.

Community Contacts

Examiners contacted a representative of a housing resource agency operating in the assessment area. The contact stated that the area continues to need additional housing stock and affordable housing. Additionally, financial education for individuals seeking homeownership and small business owners are significant needs in the area. The contact also stated that access to, and knowledge of, downpayment assistance programs is a need for potential homebuyers. Furthermore, the community needs credit-building loan options for potential borrowers with little-to-no credit history.

Credit and Community Development Needs and Opportunities

Considering information from the community contact, bank management, and demographic and economic data, examiners determined that affordable housing and credit building loans are primary credit needs in the assessment area. Additionally, community development opportunities exist for financial literacy education for small businesses and potential homebuyers.

CONCLUSIONS ON PERFORMANCE CRITERIA IN FORT WAYNE, INDIANA MSA ASSESSMENT AREA

LENDING TEST

Crossroads Bank demonstrated reasonable performance in this assessment area under the Lending Test.

Geographic Distribution

As noted previously, the assessment area is comprised of seven middle- and one upper-income census tracts. Because the assessment area does not include any low- or moderate-income census tracts, a review of geographic distribution criterion would not result in meaningful conclusions. Therefore, examiners did not evaluate this criterion.

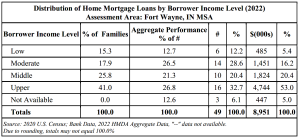

Borrower Profile

The distribution of borrowers reflects reasonable penetration among borrowers of different income levels and businesses of different sizes.

Closed-End Home Mortgage Loans

The distribution of borrowers reflects reasonable penetration among borrowers of different income levels. The bank’s lending to low-income borrowers was slightly less than, but comparable to the aggregate performance as well as the percentage of families. U.S. Census data shows that 6.6 percent of families in the assessment area had incomes below the poverty level. Those families would be unlikely to qualify for loans in amounts sufficient to purchase a home in the assessment area. The bank’s lending to moderate-income borrowers exceeds both the percentage of families and the aggregate data.

Open-End Home Mortgage Loans

The distribution of borrowers reflects excellent penetration among borrowers of different income levels. The bank’s lending to low-income borrowers significantly exceeds both the percentage of families and aggregate performance of all HMDA-reporting lenders in 2022. Additionally, the bank’s lending to moderate-income borrowers exceeds the percentage of families, while only slightly trailing the aggregate data.

Small Business Loans

The distribution of borrowers reflects, given the demographics of this assessment area, reasonable penetration among businesses of different sizes. The bank’s lending to businesses with GARs of $1 million or less slightly trails the percentage of businesses. As noted earlier, small businesses may seek alternate forms of credit such as home equity lines and credit cards, which lowers the demand for traditional small business loans. Overall, performance is reasonable.

COMMUNITY DEVELOPMENT TEST

Crossroads Bank demonstrated adequate responsiveness to the community development needs of the assessment area. Examiners considered the institution’s capacity and the need and availability of such opportunities.

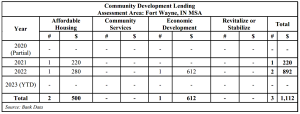

Community Development Loans

The bank originated three community development loans totaling $1.1 million during the evaluation period within this assessment area. This exceeds the performance at the previous evaluation when the bank granted one community development loan totaling $100,000. The following table illustrates the bank’s community development lending activity by year and purpose.

Notable examples of the bank’s community development loans include two loans totaling $500,000 to support affordable housing in Whitley County.

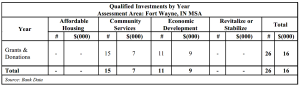

Qualified Investments

Crossroads Bank did not make any qualified investments in the assessment area during the evaluation period. The bank provided 26 donations in this assessment area totaling $16,000. Performance decreased from the prior evaluation when the bank made 34 donations totaling $31,000. The following table details the bank’s qualified donations by community development purpose.

Community Development Services

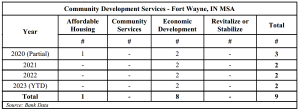

During the evaluation period, bank employees provided 9 instances of community development services, which is decrease from the 25 instances provided at the last evaluation. The following table illustrates community development services by year and purpose.

Notable examples of community development services include:

- Serving on the Board of Directors and Finance Committee of an organization providing affordable housing and community services to individuals with disabilities.

- Serving as a Board member and Treasurer of an organization providing grants to help small businesses and non-profit organizations.

APPENDICES

INTERMEDIATE SMALL BANK PERFORMANCE CRITERIA

LENDING TEST

The Lending Test evaluates the bank’s record of helping to meet the credit needs of its assessment area(s) by considering the following criteria:

- The bank’s loan-to-deposit ratio, adjusted for seasonal variation, and, as appropriate, other lending-related activities, such as loan originations for sale to the secondary markets, community development loans, or qualified investments;

- The percentage of loans, and as appropriate, other lending-related activities located in the bank’s assessment area(s);

- The geographic distribution of the bank’s loans;

- The bank’s record of lending to and, as appropriate, engaging in other lending-related activities for borrowers of different income levels and businesses and farms of different sizes; and

- The bank’s record of taking action, if warranted, in response to written complaints about its performance in helping to meet credit needs in its assessment area(s).

COMMUNITY DEVELOPMENT TEST

The Community Development Test considers the following criteria:

- The number and amount of community development loans;

- The number and amount of qualified investments;

- The extent to which the bank provides community development services; and

- The bank’s responsiveness through such activities to community development lending, investment, and service needs.

GLOSSARY

Aggregate Lending: The number of loans originated and purchased by all reporting lenders in specified income categories as a percentage of the aggregate number of loans originated and purchased by all reporting lenders in the metropolitan area/assessment area.

American Community Survey (ACS): A nationwide United States Census survey that produces demographic, social, housing, and economic estimates in the form of five year estimates based on population thresholds.

Area Median Income: The median family income for the MSA, if a person or geography is located in an MSA; or the statewide nonmetropolitan median family income, if a person or geography is located outside an MSA.

Assessment Area: A geographic area delineated by the bank under the requirements of the Community Reinvestment Act.

Census Tract: A small, relatively permanent statistical subdivision of a county or equivalent entity. The primary purpose of census tracts is to provide a stable set of geographic units for the presentation of statistical data. Census tracts generally have a population size between 1,200 and 8,000 people, with an optimum size of 4,000 people. Census tract boundaries generally follow visible and identifiable features, but they may follow nonvisible legal boundaries in some instances. State and county boundaries always are census tract boundaries.

Combined Statistical Area (CSA): A combination of several adjacent metropolitan statistical areas or micropolitan statistical areas or a mix of the two, which are linked by economic ties.

Community Development: For loans, investments, and services to qualify as community development activities, their primary purpose must:

- Support affordable housing for low- and moderate-income individuals;

- Target community services toward low- and moderate-income individuals;

- Promote economic development by financing small businesses or farms; or

- Provide activities that revitalize or stabilize low- and moderate-income geographies, designated disaster areas, or distressed or underserved nonmetropolitan middle-income geographies.

Community Development Corporation (CDC): A CDC allows banks and holding companies to make equity type of investments in community development projects. Institution CDCs can develop innovative debt instruments or provide near-equity investments tailored to the development needs of the community. Institution CDCs are also tailored to their financial and marketing needs. A CDC may purchase, own, rehabilitate, construct, manage, and sell real property. Also, it may make equity or debt investments in development projects and in local businesses. The CDC activities are expected to directly benefit low- and moderate-income groups, and the investment dollars should not represent an undue risk on the banking organization.

Community Development Financial Institutions (CDFIs): CDFIs are private intermediaries (either for profit or nonprofit) with community development as their primary mission. A CDFI facilitates the flow of lending and investment capital into distressed communities and to individuals who have been unable to take advantage of the services offered by traditional financial institutions. Some basic types of CDFIs include community development banks, community development loan funds, community development credit unions, micro enterprise funds, and community development venture capital funds.

A certified CDFI must meet eligibility requirements. These requirements include the following:

- Having a primary mission of promoting community development;

- Serving an investment area or target population;

- Providing development services;

- Maintaining accountability to residents of its investment area or targeted population through representation on its governing board of directors, or by other means;

- Not constituting an agency or instrumentality of the United States, of any state or political subdivision of a state.

Community Development Loan: A loan that:

- Has as its primary purpose community development; and

- Except in the case of a wholesale or limited purpose institution:

- Has not been reported or collected by the institution or an affiliate for consideration in the institution’s assessment area as a home mortgage, small business, small farm, or consumer loan, unless it is a multifamily dwelling loan (as described in Appendix A to Part 203 of this title); and

- Benefits the institution’s assessment area(s) or a broader statewide or regional area including the institution’s assessment area(s).

Community Development Service: A service that:

- Has as its primary purpose community development;

- Is related to the provision of financial services; and

- Has not been considered in the evaluation of the institution’s retail banking services under § 345.24(d).

Consumer Loan(s): A loan(s) to one or more individuals for household, family, or other personal expenditures. A consumer loan does not include a home mortgage, small business, or small farm loan. This definition includes the following categories: motor vehicle loans, credit card loans, home equity loans, other secured consumer loans, and other unsecured consumer loans.

Core Based Statistical Area (CBSA): The county or counties or equivalent entities associated with at least one core (urbanized area or urban cluster) of at least 10,000 population, plus adjacent counties having a high degree of social and economic integration with the core as measured through commuting ties with the counties associated with the core. Metropolitan and Micropolitan Statistical Areas are the two categories of CBSAs.

Distressed Middle-Income Nonmetropolitan Geographies: A nonmetropolitan middle-income geography will be designated as distressed if it is in a county that meets one or more of the following triggers:

- An unemployment rate of at least 1.5 times the national average;

- A poverty rate of 20 percent or more; or

- A population loss of 10 percent or more between the previous and most recent decennial census or a net migration loss of 5 percent or more over the 5-year period preceding the most recent census.

Family: Includes a householder and one or more other persons living in the same household who are related to the householder by birth, marriage, or adoption. The number of family households always equals the number of families; however, a family household may also include non-relatives living with the family. Families are classified by type as either a married-couple family or other family. Other family is further classified into “male householder” (a family with a male householder and no wife present) or “female householder” (a family with a female householder and no husband present).

FFIEC-Estimated Income Data: The Federal Financial Institutions Examination Council (FFIEC) issues annual estimates which update median family income from the metropolitan and nonmetropolitan areas. The FFIEC uses American Community Survey data and factors in information from other sources to arrive at an annual estimate that more closely reflects current economic conditions.

Full-Scope Review: A full-scope review is accomplished when examiners complete all applicable interagency examination procedures for an assessment area. Performance under applicable tests is analyzed considering performance context, quantitative factors (e.g, geographic distribution, borrower profile, and total number and dollar amount of investments), and qualitative factors (e.g, innovativeness, complexity, and responsiveness).

Geography: A census tract delineated by the United States Bureau of the Census in the most recent decennial census.

Home Mortgage Disclosure Act (HMDA): The statute that requires certain mortgage lenders that do business or have banking offices in a metropolitan statistical area to file annual summary reports of their mortgage lending activity. The reports include such data as the race, gender, and the income of applicants; the amount of loan requested; and the disposition of the application (approved, denied, and withdrawn).

Home Mortgage Loans: Includes closed-end mortgage loans or open-end line of credits as defined in the HMDA regulation that are not an excluded transaction per the HMDA regulation.

Housing Unit: Includes a house, an apartment, a mobile home, a group of rooms, or a single room that is occupied as separate living quarters.

Limited-Scope Review: A limited scope review is accomplished when examiners do not complete all applicable interagency examination procedures for an assessment area. Performance under applicable tests is often analyzed using only quantitative factors (e.g, geographic distribution, borrower profile, total number and dollar amount of investments, and branch distribution).

Low-Income: Individual income that is less than 50 percent of the area median income, or a median family income that is less than 50 percent in the case of a geography.

Low Income Housing Tax Credit: The Low-Income Housing Tax Credit Program is a housing program contained within the Internal Revenue Code of 1986, as amended. It is administered by the U.S. Department of the Treasury and the Internal Revenue Service. The U.S. Treasury Department distributes low-income housing tax credits to housing credit agencies through the Internal Revenue Service. The housing agencies allocate tax credits on a competitive basis.

Developers who acquire, rehabilitate, or construct low-income rental housing may keep their tax credits. Or, they may sell them to corporations or investor groups, who, as owners of these properties, will be able to reduce their own federal tax payments. The credit can be claimed annually for ten consecutive years. For a project to be eligible, the developer must set aside a specific percentage of units for occupancy by low-income residents. The set-aside requirement remains throughout the compliance period, usually 30 years.

Market Share: The number of loans originated and purchased by the institution as a percentage of the aggregate number of loans originated and purchased by all reporting lenders in the metropolitan area/assessment area.

Median Income: The median income divides the income distribution into two equal parts, one having incomes above the median and other having incomes below the median.

Metropolitan Division (MD): A county or group of counties within a CBSA that contain(s) an urbanized area with a population of at least 2.5 million. A MD is one or more main/secondary counties representing an employment center or centers, plus adjacent counties associated with the main/secondary county or counties through commuting ties.

Metropolitan Statistical Area (MSA): CBSA associated with at least one urbanized area having a population of at least 50,000. The MSA comprises the central county or counties or equivalent entities containing the core, plus adjacent outlying counties having a high degree of social and economic integration with the central county or counties as measured through commuting.

Middle-Income: Individual income that is at least 80 percent and less than 120 percent of the area median income, or a median family income that is at least 80 and less than 120 percent in the case of a geography.

Moderate-Income: Individual income that is at least 50 percent and less than 80 percent of the area median income, or a median family income that is at least 50 and less than 80 percent in the case of a geography.

Multi-family: Refers to a residential structure that contains five or more units.

Nonmetropolitan Area (also known as non-MSA): All areas outside of metropolitan areas. The definition of nonmetropolitan area is not consistent with the definition of rural areas. Urban and rural classifications cut across the other hierarchies. For example, there is generally urban and rural territory within metropolitan and nonmetropolitan areas.

Owner-Occupied Units: Includes units occupied by the owner or co-owner, even if the unit has not been fully paid for or is mortgaged.

Qualified Investment: A lawful investment, deposit, membership share, or grant that has as its primary purpose community development.

Rated Area: A rated area is a state or multistate metropolitan area. For an institution with domestic branches in only one state, the institution’s CRA rating would be the state rating. If an institution maintains domestic branches in more than one state, the institution will receive a rating for each state in which those branches are located. If an institution maintains domestic branches in two or more states within a multistate metropolitan area, the institution will receive a rating for the multistate metropolitan area.

Rural Area: Territories, populations, and housing units that are not classified as urban.

Small Business Investment Company (SBIC): SBICs are privately-owned investment companies which are licensed and regulated by the Small Business Administration (SBA). SBICs provide long-term loans and/or venture capital to small firms. Because money for venture or risk investments is difficult for small firms to obtain, SBA provides assistance to SBICs to stimulate and supplement the flow of private equity and long-term loan funds to small companies. Venture capitalists participate in the SBIC program to supplement their own private capital with funds borrowed at favorable rates through SBA’s guarantee of SBIC debentures. These SBIC debentures are then sold to private investors. An SBIC’s success is linked to the growth and profitability of the companies that it finances. Therefore, some SBICs primarily assist businesses with significant growth potential, such as new firms in innovative industries. SBICs finance small firms by providing straight loans and/or equity-type investments. This kind of financing gives them partial ownership of those businesses and the possibility of sharing in the companies’ profits as they grow and prosper.

Small Business Loan: A loan included in “loans to small businesses” as defined in the Consolidated Report of Condition and Income (Call Report). These loans have original amounts of $1 million or less and are either secured by nonfarm nonresidential properties or are classified as commercial and industrial loans.

Small Farm Loan: A loan included in “loans to small farms” as defined in the instructions for preparation of the Consolidated Report of Condition and Income (Call Report). These loans have original amounts of $500,000 or less and are either secured by farmland, including farm residential and other improvements, or are classified as loans to finance agricultural production and other loans to farmers.

Underserved Middle-Income Nonmetropolitan Geographies: A nonmetropolitan middle- income geography will be designated as underserved if it meets criteria for population size, density, and dispersion indicating the area’s population is sufficiently small, thin, and distant from a population center that the tract is likely to have difficulty financing the fixed costs of meeting essential community needs.

Upper-Income: Individual income that is 120 percent or more of the area median income, or a median family income that is 120 percent or more in the case of a geography.

Urban Area: All territories, populations, and housing units in urbanized areas and in places of 2,500 or more persons outside urbanized areas. More specifically, “urban” consists of territory, persons, and housing units in places of 2,500 or more persons incorporated as cities, villages, boroughs (except in Alaska and New York), and towns (except in the New England states, New York, and Wisconsin).

“Urban” excludes the rural portions of “extended cities”; census designated place of 2,500 or more persons; and other territory, incorporated or unincorporated, including in urbanized areas.